Why We're Up 82% on MP Materials — And Why the Pentagon Just Became Its Biggest Backer

A rare earth bet pays off. Here's what we saw early—and how this deal changes everything.

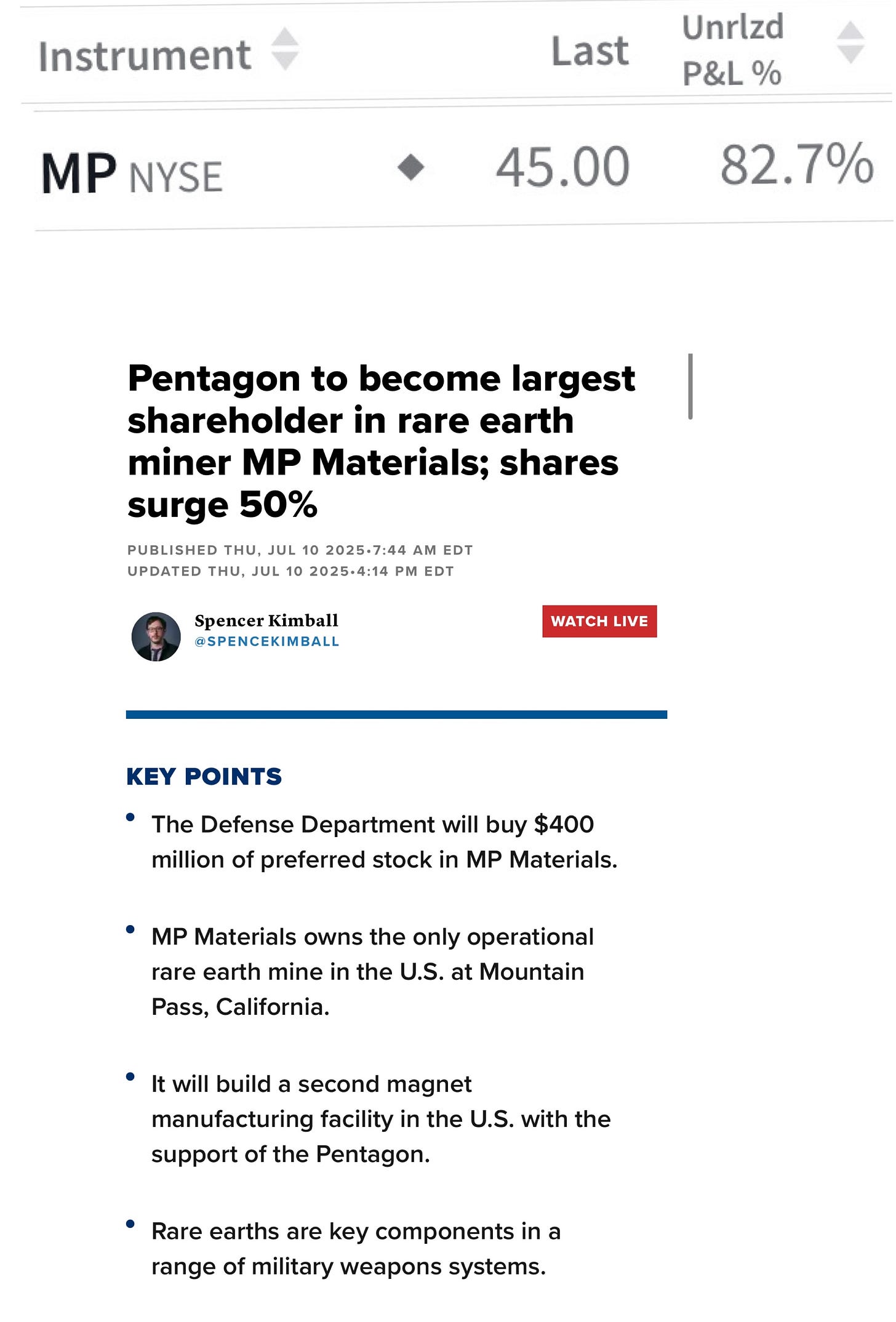

Everyone’s talking about the Pentagon’s $400 million bet on MP Materials.

We were already in.

This week, shares of MP Materials surged 50% after the U.S. Department of Defense announced it would become the company’s largest shareholder. The move marks a strategic shift by the U.S. government to secure its rare earth supply chain — and it just gave our investment a massive tailwind.

We're now up 82%.

Let’s break down why we invested months ago — and why we believe this story is far from over.

Why We Bought MP Before the Headlines

Back then, most investors ignored rare earths.

Too boring. Too complicated. Too political.

But we saw something others didn’t.

MP Materials isn’t just a mining company. It’s a national asset in the making.

Here’s what stood out to us:

Strategic monopoly: MP operates the only active rare earth mine in the United States—Mountain Pass, California.

Mission-critical use case: Rare earth elements like NdPr are essential for magnets used in F-35 fighter jets, submarines, drones, and missile guidance systems. If the U.S. wants defense independence, it needs MP.

Vertical integration: MP wasn’t just digging up ore. It had a clear plan to build a full end-to-end magnet supply chain inside the U.S.

Geopolitical tailwind: With 70% of U.S. rare earth imports coming from China, reshoring the supply chain isn’t just smart. It’s inevitable.

Savvy leadership: CEO James Litinsky had a unique vision—combining public-market discipline with private-sector urgency. We liked the alignment, the execution, and the narrative.

So we got in.

What the Pentagon Deal Means

Fast-forward to now. The Pentagon didn’t just write a check — it’s rewriting the playbook for public-private partnerships in strategic industries.

Here’s what’s in the deal:

$400 million investment in preferred stock and a 10-year warrant

15% ownership stake for the U.S. government—making it MP’s largest shareholder

A second magnet facility (dubbed “10X”) to be built in the U.S. with 10,000 metric tons annual capacity, backed by $1 billion from JPMorgan and Goldman Sachs

10-year offtake agreement: The Pentagon will buy 100% of the magnets produced

$110/kg price floor for neodymium-praseodymium oxide (NdPr), with a 30% profit share for the DoD if prices exceed the floor

$150 million loan for Mountain Pass to expand rare earth separation

Litinsky was clear: this is not a nationalization. It’s a model for accelerating market-driven solutions in sectors where the U.S. must compete.

And the market agreed—MP’s market cap jumped $2.5 billion in a day.

What’s Next

This isn’t just a one-off trade.

It’s a long-term bet on a strategic reshuffling of global supply chains—especially in energy, defense, and technology.

The Pentagon’s move validates what we believed all along:

That MP isn’t just a rare earth miner.

It’s the foundation of America’s rare earth independence.

And it’s still early.

We're holding.

Bottom Line:

When you see national interest aligning with commercial scale—and both are backed by capital and policy—you don't just have an investment. You have a movement.

We believe this is one of those rare cases.

Disclaimer:

This post is for informational purposes only and reflects my personal views, not investment advice. It does not constitute a recommendation to buy or sell any securities. Please do your own research before making any investment decisions.