Warren Buffett Saw This Trade Disaster Coming 20 Years Ago—And He Had a Fix (It Wasn’t Tariffs)

Buffett warned America was selling itself off. His 2003 solution was bold, market-driven, and completely different from what Trump is pushing today.

Warren Buffett has been warning about America’s trade deficit for decades. But here’s where people get it wrong:

They think Buffett would be all-in on Trump’s tariffs.

Reality? Not even close.

Back in 2003, Buffett outlined a plan to fix America’s growing trade imbalance. But it wasn’t tariffs. It was Import Certificates (ICs)—a market-driven solution that doesn’t target specific countries or industries.

Fast forward to today, and Buffett is once again talking about trade. But this time, he’s calling out tariffs for what they really are—a tax on consumers that drives up inflation.

So, did Buffett change his mind? Nope. His concern has always been the same. But he’s making it clear: tariffs are the wrong fix.

Buffett’s 2003 Warning: America Is Selling Itself Off

Buffett saw the trade deficit problem coming a mile away. In 2003, he laid out a brutal reality:

The U.S. was financing its overconsumption by selling off its own assets.

He used a metaphor of two islands: Squanderville (America) and Thriftville (foreign countries). Squanderville was happily consuming goods imported from Thriftville, paying for them with IOUs (debt). Over time, Thriftville cashed in those IOUs and bought up Squanderville’s land, businesses, and assets.

Sound familiar? That’s exactly what’s been happening with foreign ownership of U.S. companies, stocks, and real estate. Buffett’s prediction was spot on.

He wasn’t just theorizing. He was worried enough to put his money where his mouth was, shifting Berkshire Hathaway’s investments into foreign currencies.

Why? Because he saw the dollar heading for trouble.

Back then, the U.S. had already moved from being a net creditor (owning more of the world’s assets than the world owned of ours) to a net debtor. The pace was accelerating, and Buffett saw that if it didn’t stop, future generations of Americans would be working not just to sustain themselves but to pay off debt to foreign owners.

The 2003 Fix: Import Certificates, Not Tariffs

Buffett knew the trade deficit needed a solution—but he wasn’t about to push for old-school tariffs.

Instead, he proposed Import Certificates (ICs). Here’s how they work:

· U.S. exporters earn ICs based on the value of their exports.

· Foreign companies that want to sell goods in the U.S. must buy ICs from American exporters.

· This forces trade balance, ensuring the U.S. only imports as much as it exports.

His words? “A tariff called by another name.”

But the key difference? ICs wouldn’t punish specific countries or industries. They’d create a market-based solution where global trade adjusts naturally—without the economic chaos of trade wars.

And that’s the part people miss when they try to say Buffett was pro-tariff. He wasn’t looking to start a fight. He was looking for a way to balance the playing field without putting unnecessary burdens on consumers.

Fast Forward to Today: Buffett Still Doesn’t Like Tariffs

Jump to 2024, and Buffett is once again talking about trade.

When asked about tariffs, his response? “They’re an act of war to some degree.”

Think about that for a second. An act of war. Not just bad economics. Not just an inconvenience. But a direct attack.

Buffett isn’t just saying tariffs don’t work—he’s saying they escalate tensions in ways that can spiral out of control.

And what about inflation? Buffett makes it clear: tariffs will push prices higher and hurt small businesses that rely on imports.

“The Tooth Fairy doesn’t pay them,” he quipped. In other words: American consumers do.

When you slap tariffs on imported goods, those costs don’t magically disappear. They get passed down the chain—from manufacturers to retailers to everyday people buying groceries, electronics, and household items.

And guess what? Companies don’t just eat those costs. They raise prices.

We’re already in an inflationary environment where people are struggling with higher living costs. Now imagine stacking artificial price hikes on top of that. That’s what tariffs do.

Did Buffett change his stance? No. He’s just reminding people that tariffs aren’t the magic fix politicians want them to be.

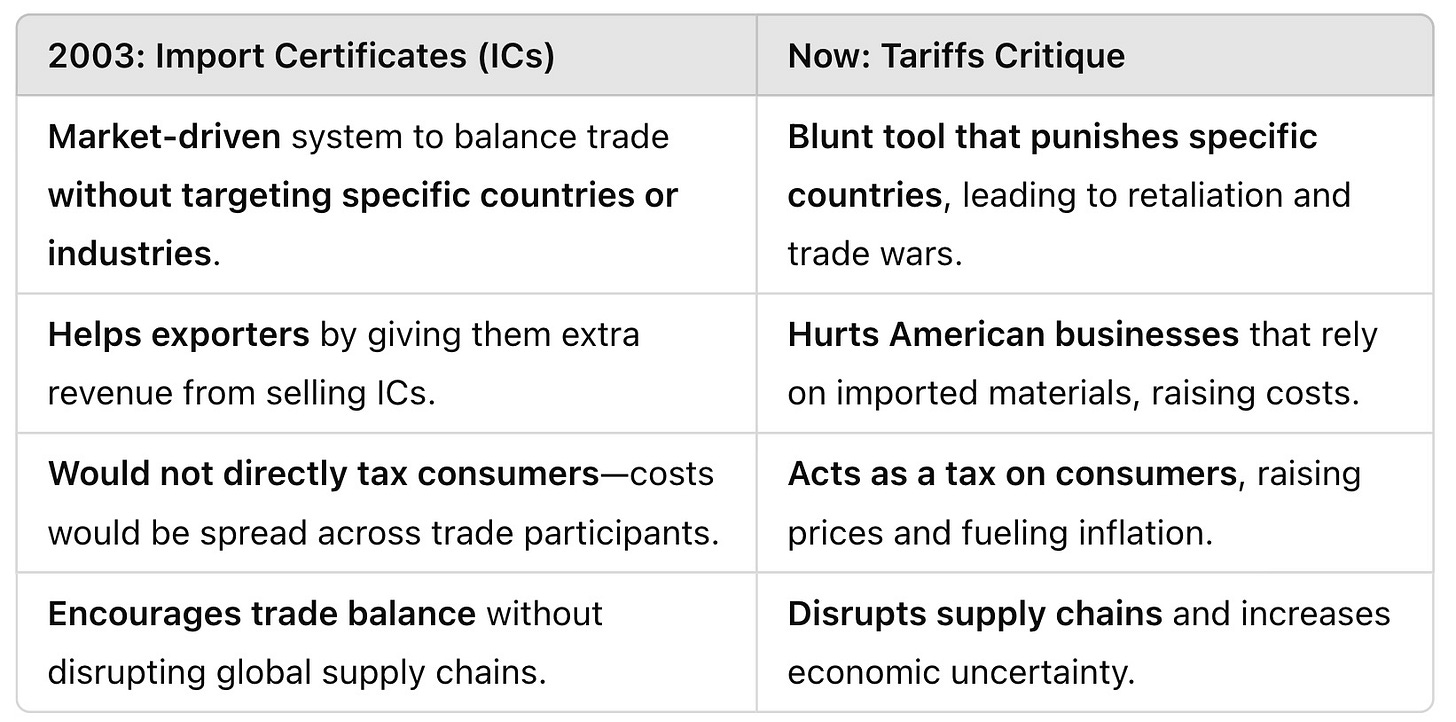

Comparing Buffett’s 2003 and 2024 Views

Buffett’s IC plan was about fixing the trade deficit without punishing consumers.

Tariffs? They pick winners and losers and pass the cost onto Americans.

Buffett’s Core Message Hasn’t Changed

Buffett is playing the long game. He’s been watching the U.S. trade deficit balloon for decades, and he still sees it as a major economic risk.

But here’s the deal: Trade deficits matter. But tariffs aren’t the way to fix them.

His 2003 proposal was about balancing trade without wrecking the economy. His 2024 stance is about reminding people that tariffs make things worse, not better.

So if you hear someone saying, “Buffett would love Trump’s tariffs!”—you know better. Buffett warned about this problem 20 years ago. But he also warned about the wrong solutions.

He wanted a fair, balanced approach that rewarded exporters without unfairly taxing consumers. Tariffs? They’re a political tool that rarely helps in the long run.

They create retaliation. They raise prices. They don’t actually fix the underlying trade imbalances.

And Buffett—arguably one of the sharpest economic minds of our time—isn’t buying into the hype.

Tariffs? They’re just another mistake waiting to happen.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e