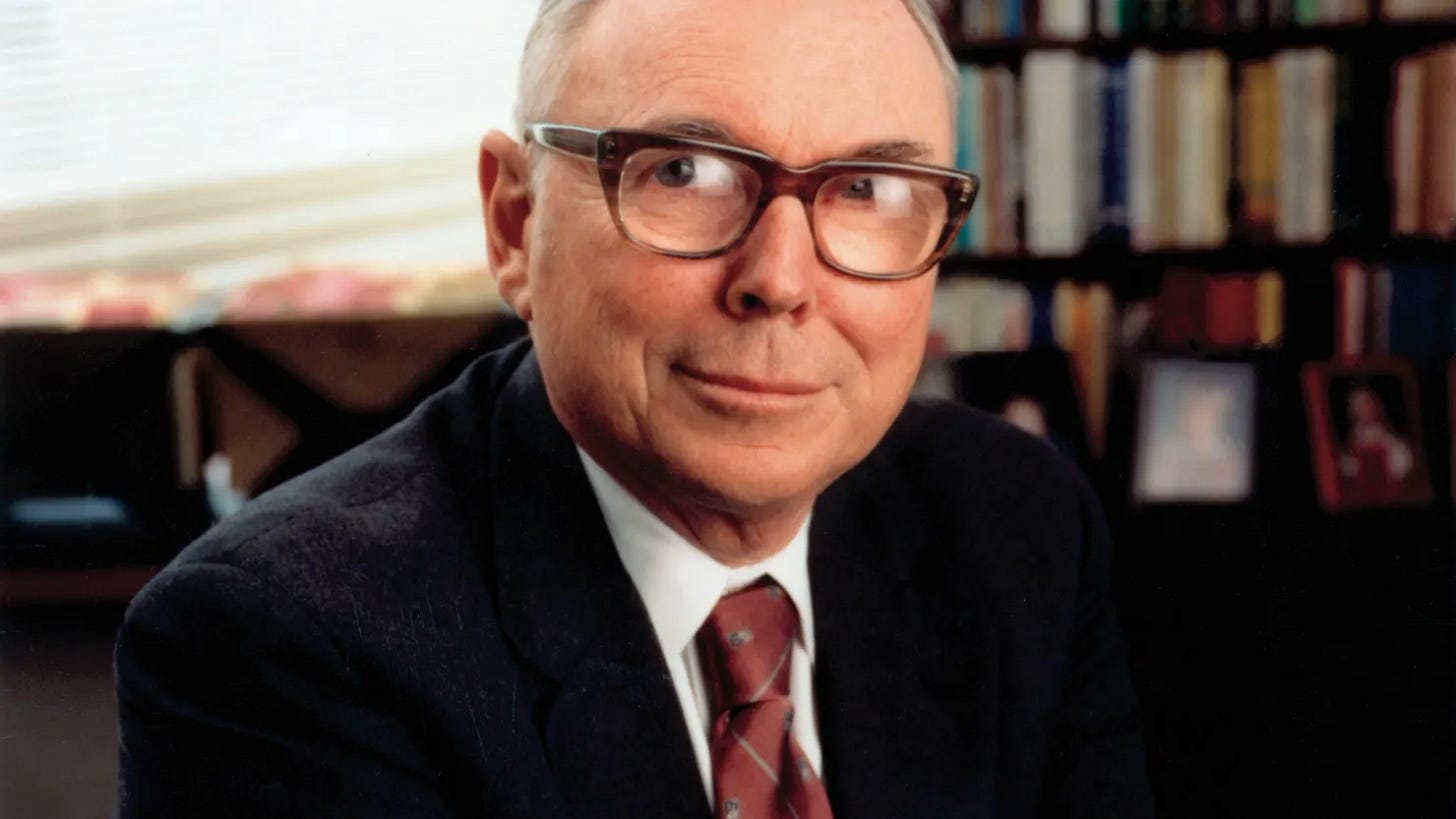

The Hidden Secrets Charlie Munger Used to Master Life’s Toughest Decisions and Build a Trillion-Dollar Empire

Discover how Charlie Munger’s timeless wisdom reshaped decision-making, built lasting wealth, and transformed lives.

At 99 years old, Charlie Munger, the man behind Berkshire Hathaway wasn’t just wealthy—he was the smartest person in the world. Munger taught us how to stop chasing stock tips and start thinking for the long term. He showed us how to make better decisions, not just in investing but in life.

Recently, his long-time mentee, Li Lu, shared some jaw-dropping lessons from decades of mentorship. If you’ve ever wondered what separates ordinary thinkers from extraordinary ones, this is it.

The Game-Changer: Value Investing, Reinvented

Investing used to be simple—buy cheap stocks and hope for the best. Then Charlie Munger showed up.

Munger took Benjamin Graham’s “buy low, sell high” philosophy and supercharged it. He said it wasn’t enough to buy undervalued stocks—you needed to buy great companies.

As Li Lu explained:

“Charlie accepted Mr. Graham’s original explanation of value investing, namely: first, stocks are part of the company’s ownership, not just a piece of paper; second, the existence of the market is to help these real value investors, not to guide you what to do, which is the so-called 'Mr. Market' concept; third, investment must have a sufficient safety margin.”

But here’s the twist. Munger added his own rule: Look for high-quality companies within your circle of competence. Then hold on for decades. This wasn’t just about making money—it was about building wealth that lasts.

BYD: A Masterclass in Playing the Long Game

Let’s talk about BYD, the Chinese electric vehicle (EV) giant. Munger and Li Lu first invested over 22 years ago. Since then, BYD’s stock price has plummeted more than 50% at least six or seven times. At one point, it even dropped by 80%. Most people would’ve run screaming for the exits.

But not Munger.

“We didn’t feel very stressed because we knew that it was creating new value every year,” said Li Lu.

That’s the power of Munger’s long-term mindset. He didn’t care about market noise. He cared about the company’s intrinsic value—its ability to innovate and dominate. BYD’s leadership in batteries and EV technology gave it a moat (Buffett and Munger’s favorite word) that made it nearly unstoppable.

“At any time, we must be able to estimate the value of the company itself. When the price and value deviate, we can also selectively increase our holdings,” Li Lu added.

The result? BYD became one of the world’s leading EV manufacturers. And Munger showed us how patience and conviction pay off.

Charlie’s 4 Rules for Smarter Decisions

Munger didn’t just teach us how to invest—he taught us how to think. Here are his four levels of rationality, straight from Li Lu’s reflections.

1. Start With First Principles

Munger was a first-principles thinker. He broke down problems to their fundamental truths, stripping away assumptions and fluff. Li Lu explained it like this:

“Physics, starting from Aristotle, always has to discover the first driving force for everything, so it is called the first principle, which is to derive logical conclusions from facts and axioms. So whether your conclusion is correct actually depends on the basic facts, basic assumptions, and reasoning process.”

If you want to think clearly, Munger would say, you need to start at the very foundation. No shortcuts. No wishful thinking.

2. Use Multidisciplinary Thinking

Munger famously believed in creating a “latticework of mental models.” He studied everything—economics, biology, psychology, history. Why? Because life’s problems don’t come neatly labeled. Li Lu explained:

“The real world is actually very complex and contains fundamental problems from all aspects, When we do research, we must learn the knowledge of each discipline separately, but when it comes to application, you must string this knowledge together, just like weaving a fence-like net.”

It’s not about being an expert in one field. It’s about connecting the dots across many.

3. Avoid Systematic Irrationality

Munger knew that humans are wired to make dumb mistakes. So he studied them—obsessively. He even created a checklist of 25 biases to avoid, including overconfidence, loss aversion, and the sunk cost fallacy.

“He studied a series of mistakes that humans make when rationalizing their behavior under irrational circumstances,” said Li Lu. “His rationality means avoiding all systematic traps in human thinking.”

Here’s the kicker: Munger’s ability to avoid mistakes was just as important as his ability to find great opportunities.

4. Respect Common Sense

This one’s so simple, it’s genius: Do what works. Avoid what doesn’t.

Li Lu described it best:

“When you violate common sense, you will pay a price, and these prices will disprove these common sense.”

So many people ignore the basics—then wonder why they fail. Munger never made that mistake. He kept it simple, sticking to what he knew worked.

The Secret Weapon: Lifelong Learning

Munger wasn’t just a smart guy—he was a learning machine. He read constantly, absorbing knowledge from every possible source. And here’s the crazy part: He wasn’t reading to act. He was reading to think.

Li Lu shared a story about how Munger read Barron’s every week for 50 years but acted on only one investment opportunity. One. That’s what discipline looks like.

And get this—Munger made an investment at the age of 99. According to Li Lu:

“There was a stock that everyone disliked… Charlie studied this company for a long time and invested in it when he was 99 years old. The week before he died, this stock had doubled from the time he started investing.”

Even in his final year, Munger was still learning, still thinking, and still winning.

Why Patience Is the Ultimate Superpower

Munger’s philosophy boiled down to one word: patience. He believed that the best rewards in life come from playing the long game.

Li Lu told a story about their early investment days:

“In our early days, like in the first year, 1998, the book loss was 19% because some people wanted to withdraw. I had no choice but to sell part of it. But the remaining ones rose by more than 50% or more than 100% in 1999 and 2000.”

The lesson? Stay the course. When you focus on the long term, short-term setbacks don’t matter.

Munger and Buffett: The Dream Team

Munger wasn’t just Buffett’s partner—he was his intellectual equal. Together, they built Berkshire Hathaway into a trillion-dollar empire.

“Charlie is the designer, and Warren is the general contractor,”

Their partnership worked because they complemented each other. Buffett brought the charm. Munger brought the rigor. Together, they were unstoppable.

Final Thoughts: A Blueprint for Life

Charlie Munger didn’t just teach us how to invest. He taught us how to live. His principles—rationality, patience, humility, and lifelong learning—are a roadmap for anyone looking to make smarter decisions.

So here’s the big takeaway: Stop chasing quick wins. Play the long game. Learn every day. And most importantly, think for yourself.

As Munger himself said:

“My sword will be left to those who can wield it.”

Pick up the sword. Start thinking like Munger.

PS: A huge thank you to all our readers! Our book - Invest Like Warren Buffett – Reading Financial Statements Made Easy has reached the #1 ranking in all three investing categories: Stock Market Investing (Kindle Store), Two-Hour Business & Money Short Reads, and Investing Basics. Your support means the world!